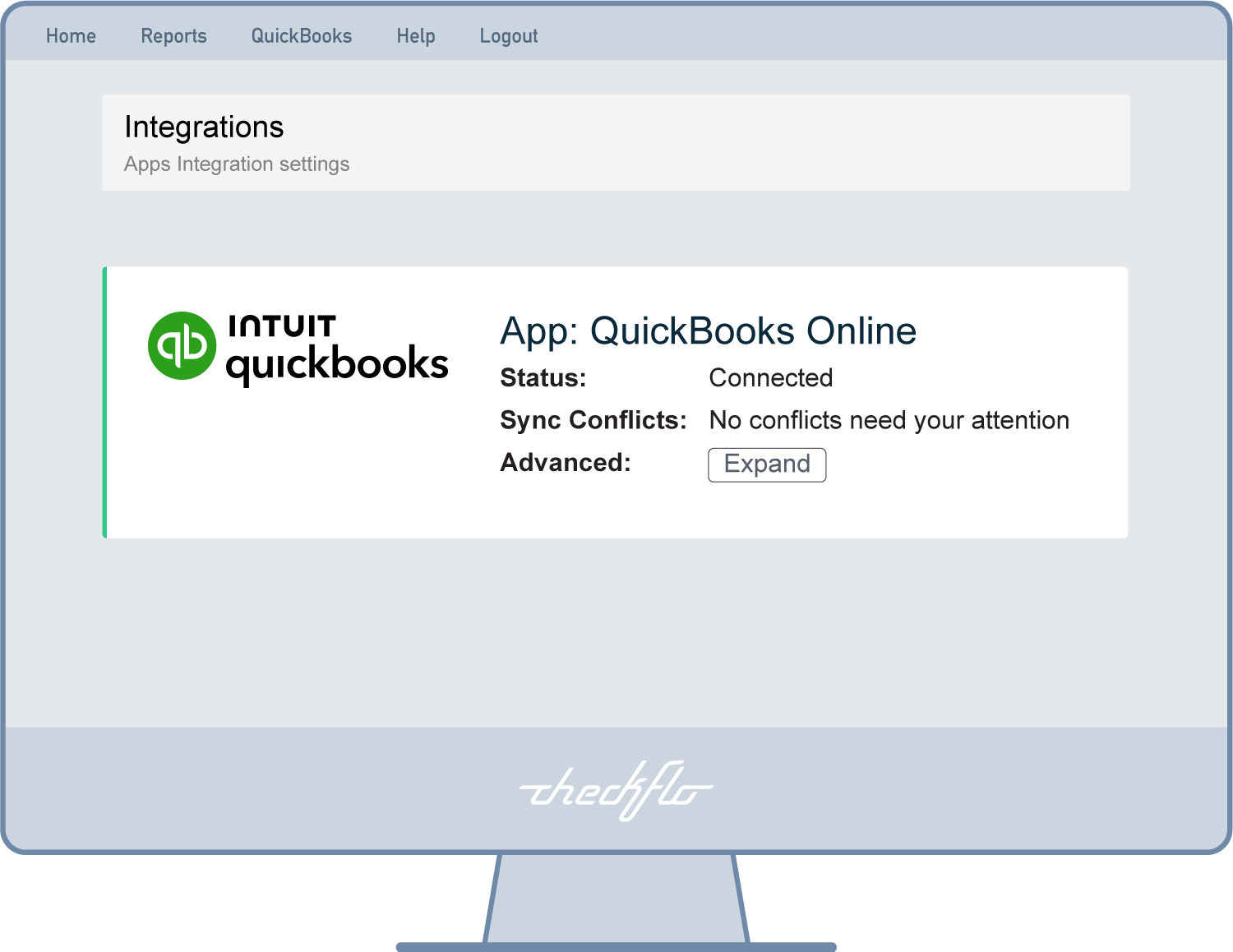

Integrating Checkflo with QuickBooks

Syncing Checkflo with your QuickBooks account will allow you to import all your check payments from QuickBooks all while still benefiting from creating those checks within QuickBooks!

These benefits include:

- Printing your checks directly from QuickBooks so that you don’t have to manually write them.

- Creating checks directly in QuickBooks, you don’t have to manually enter the check data later when it is time to reconcile your checking account with your bank statements.

- Your QuickBooks account is always up-to-date with the most recent expenses you’ve paid.

By connecting Checkflo to QuickBooks you’re enhancing those benefits mentioned above! Checkflo provides a one-stop source for all your check processing, printing and mailing needs which will help you save time and money! All while improving operational efficiencies and reducing administrative costs with less effort and paperwork. Start leveraging our advanced printing capabilities to help your organization quickly boost productivity and discover cost savings.

Before starting you need to have a valid QuickBooks Online Account.