Maximizing Payment Security with Positive Pay from Checkflo

For businesses that depend on paper checks, safeguarding their accounts and preserving client trust in their payment processes is of paramount importance. Positive Pay is a vital tool that not only strengthens every check fraud prevention program but also helps reduce liabilities and upholds a company’s valuable reputation. By implementing Positive Pay, businesses can effectively protect their financial transactions while ensuring a secure and trustworthy payment environment.

Understanding Positive Pay

Positive Pay is a fraud prevention system used by banks to verify the authenticity of checks presented for payment. It helps prevent check fraud by cross-referencing the details of a submitted check against a pre-approved list provided by the issuing company. If there’s a discrepancy, the bank can quickly identify and flag the suspicious transaction.

When the information on the check presented for deposit doesn’t match the report, the bank can take actions such as:

-

- Notify you through an exception report.

- Withhold payment until you advise the bank to accept or reject the check.

- Flag the check.

- Notify a company representative.

- Seek permission to clear the check.

Benefits:

- Enhanced Fraud Prevention.

- Improved Operational Efficiency.

- Strengthened Reputation and Client Trust.

Checkflo: Your Partner in Secure Check Payments

Checkflo provides a complimentary Positive Pay reporting service, designed to help businesses maximize their payment security. This feature streamlines the process of converting your payment data into a file that aligns with your bank’s specifications. Enjoy enhanced security for every transaction, whether you’re processing ten or 100,000 payments, ensuring peace of mind for you and your clients.

In addition to the Positive Pay report, Checkflo offers a comprehensive suite of security features to protect your transactions, including:

- Data encryption.

- Batch approvals.

- Audit-approved reports.

These fraud prevention tools are integrated directly into your payment flow at no extra charge, delivering an added layer of security and confidence for both your business and your clients.

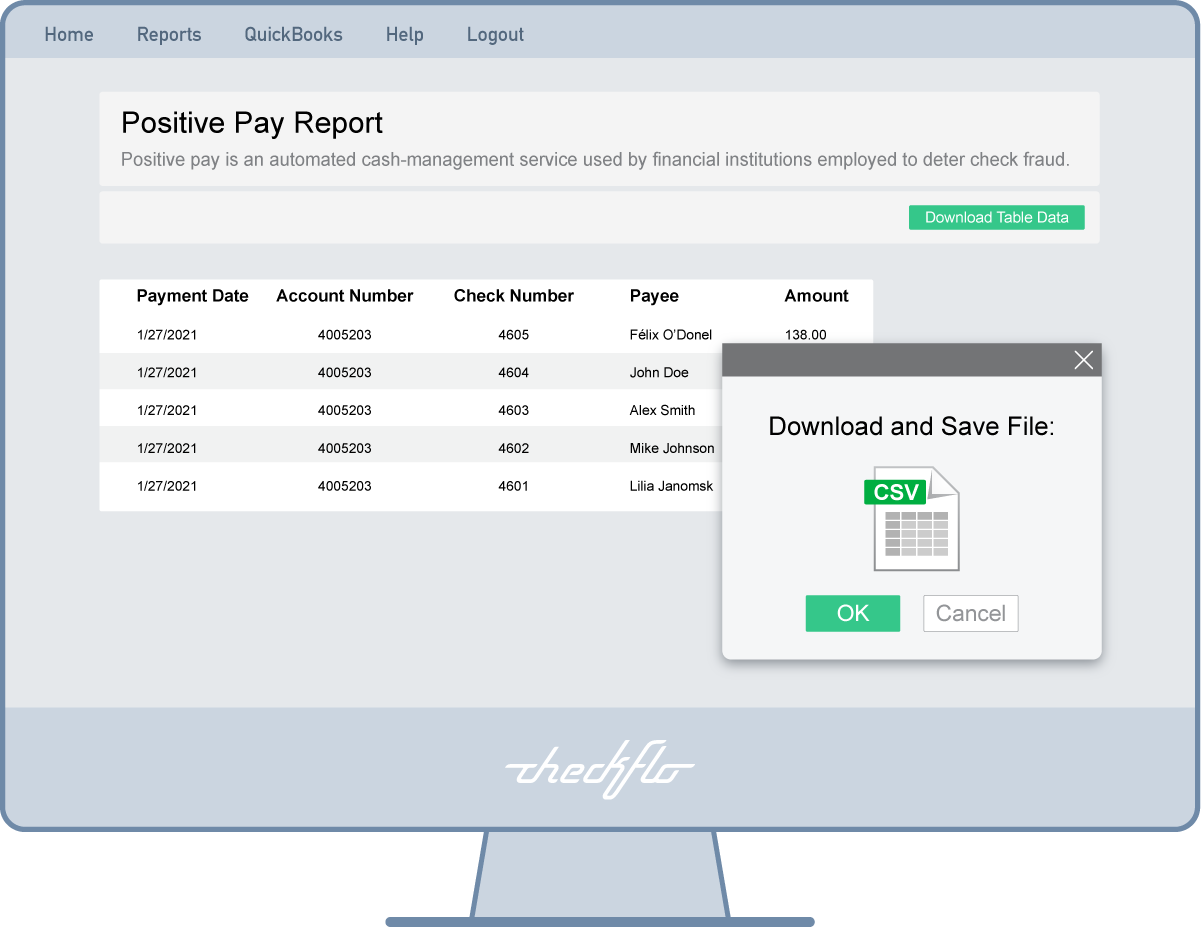

Implementing Positive Pay with Checkflo

Integrating Positive Pay into your business is a breeze with Checkflo. Simply submit your checks via QuickBooks Online, CSV file upload, or API integration. Checkflo will then automatically generate a Positive Pay file formatted to your bank’s specifications for easy submission.

Checkflo’s Positive Pay Compatibility

Checkflo’s Positive Pay format supports all major US banks, allowing you to generate a report with all the essential details your bank needs to protect you from check fraud. We also offer a universal CSV file format for added convenience.

Our platform is Payee Positive Pay compatible, ensuring that the generated files include the payee’s identity on each check. Checkflo’s Positive Pay report contains important information such as the date, amount, check number/account, payee name, and more for thorough verification.

Experience Checkflo’s Security First-hand

We invite you to discover first-hand how Checkflo can back up your payment data and protect it with multiple layers of security. By partnering with us, you’ll enjoy enhanced security measures that integrate seamlessly into your payment processes to minimize the risk of check fraud and keep your business running smoothly.

Get Started

For custom Positive Pay reports or for more information on secure check printing & disburment services, contact Checkflo at 1-855-561-4273 or email us at info@Checkflo.com